|

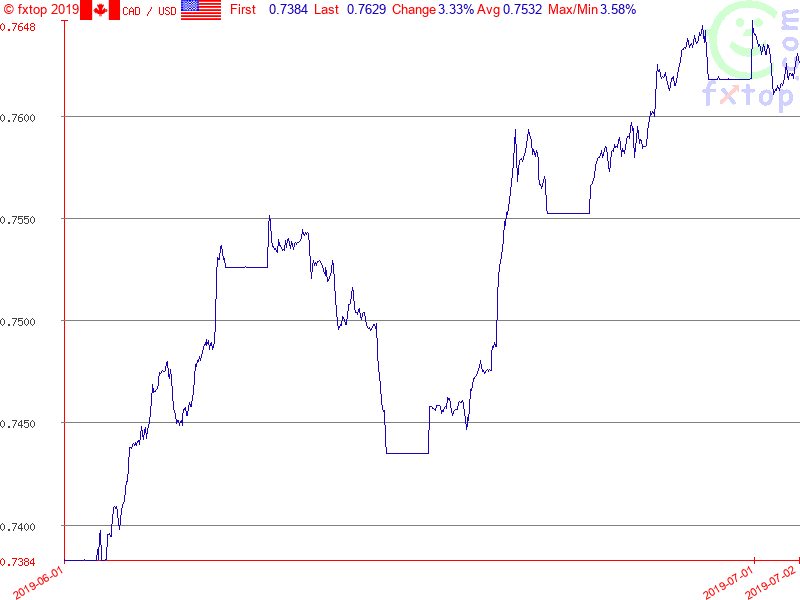

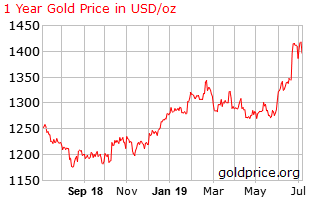

Canadian Dollar Gains 3.3% in June - By Dan Good Canadian Dollar at 76 cents Our dollar has advanced rather sharply over the last month as the American economy has showed signs of slowing. This has led to a pretty dramatic drop in interest rates in the U.S. which makes holding American bonds far less attractive for foreigners. The U.S. 10 year treasury is at 1.975% today which means that if you held this bond for the next 10 years you will receive 1.975% per year over this period and then your money back. This is a huge drop from the high of 3.263% reached over the past 12 months. In Canada the rate is even lower at 1.46%. Along with higher bond prices (old bonds yielding 3% or more are more attractive and therefore priced higher) equity prices have also rallied in the States. The American Standard and Poor’s 500 index hit an all-time high today. But it is a rather strange market in that fundamentally cheap stocks are not advancing while “expensive” stocks are becoming more popular. Who is to say the markets have to be rational? Joel Tillinghast with Fidelity has been touted as one of the best but his Northstar fund is basically flat for the year. This makes little sense as Joel focuses on using the dividend discount method for valuing securities. If you use a lower discount rate (with lower interest rates) you should automatically get a pop up in value. This lag has Dan Dupont calling this fund an excellent value today. High Growth Stocks Advance In contrast to the lagging value funds, Fidelity’s Mark Schmehl has seen his Fidelity Global Innovators Currency Neutral Fund advance some 33.5% so far this year. The non-hedged version advanced 30.4%. I would suggest a portion of investors’ funds be hedged in case the Canadian dollar continues to advance. As for high growth funds this may just be a repeat of the experience in 2018 when most gains got wiped out in the last quarter. An Annoying Financial Move I am seeing some patterns that seem to repeat themselves at market tops. One of the companies whose shares I currently short is doing a financial transaction that appears to be a way for the supporting shareholders to unload a portion of their holdings (again). Last September BRP Inc (Bombardier Recreational Products) shareholders sold over $400 million in stock back to the public at $47 US per share. BRP received no money on this transaction. This was roughly $61.60 Cdn. The shares currently trade at less than $49. Now they are proposing to have the company buy back $300 million in stock from themselves and the public. What is interesting is that BRP only has $95 million in cash on their books and their book value is negative $3.38 per share. Someone is being had here! A similar manipulated stock is Dollarama that has a negative book value of $1.00 and trades at close to $50. Small Stocks Are Unloved One of the top performing funds in the past 10 years was Templeton’s Bisset Microcap fund. If you check out its performance numbers you will find that it has averaged -10% per year over the past 5 years and still has a positive 7% per year number over the past 10. I am not sure what it will take for investors to become enamored with small company shares again but I think this last year may have been the peak of pessimism for small company investing. I am currently quite active in this area for the first time in some 7 years as more shares hit my value target. Canadian Dollar Chart for June Lowering Fees to Investors ETF funds have become more popular as a way to invest due to their relatively low fee structure and the current popularity of index investing. I think the aphorism that a rising tide lifts all boats can be applied to the markets today so active management should be able to outperform index investing in the future but with this comes an additional cost. As both an advisor and dealer I can “get around” this conundrum by offering to hold a portion of my client’s funds in fee based funds and waiving my fees. For example, Vanguard offers four different funds in Canada where their management fees will vary between 0.34 per cent and 0.40 per cent – about half the cost of the mutual - fund industry average. The management fee will vary up or down over time, up to a maximum of 0.50 per cent, based on the investment performance of each fund. If I waive my fee then charges to the client will be about .50% which should add at least 1% to investor’s performance returns. Gold Returns to Glory

Leave a Reply. |

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|