|

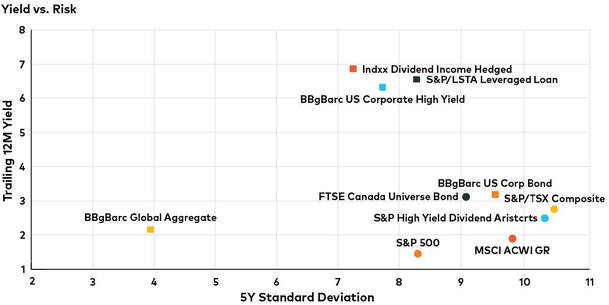

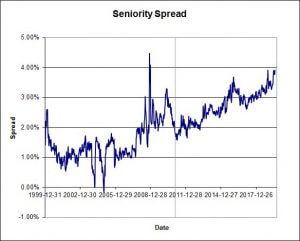

By Dan Good Bond Market is Mostly Misunderstood I was known as “Dan Bond” for first decade of my career as I focused on providing high yielding Government of Canada bonds for my client’s portfolios. My reasoning was why invest in equities when bonds were yielding 10% in a virtually risk free asset? Now it is a different story as the 10 year Government of Canada bond yield is an abysmal 1.4%. While this rate is low, the yield has actually improved from the under 1% yield of three years ago on 10 year bonds. So while Canadian bond funds may look “good” this year (Fidelity’s Canadian bond fund is up 8% and Mackenzie’s is plus 7.5%) over the past 3 years returns have been mediocre at best with 2% for Fidelity and 2.5% for Mackenzie over this period. So if you are looking for yield as an income focused investor, Government Bonds today are just not the best place to be parking your money. Yield Versus Risk As the chart (thank you Morningstar Research) on the back of this page shows, your yields are substantially higher (roughly 6%) on high yield corporate bonds, leveraged corporate loans and dividend paying equities than you can get holding Canadian bonds. But, obviously, obtaining this higher yield comes with higher associated risk of default. If you have the stomach to hold dividend paying equities this might be your best bet. For example, I have been buying public shares of AGF as they recently “monetized” or turned to cash one of their U.K. holdings. I like companies with a lot of cash as it gives me comfort – a margin of safety -versus holding companies with a lot of debt. If I just sit on AGF shares I receive a dividend of some 5.5% annually. On an after tax basis this is equivalent to earning 7% in interest income. The other benefit with AGF is that they only pay out 60% of their earnings in the form of a dividend which means they can reinvest their extra earnings, grow the company, and theoretically increase their dividend in the future. Now comes the associated risk part. If you bought the shares at their recent high of $6.50 a few weeks ago you would have lost 10% so far as the shares trade at only $5.75 today. For clients, it might be easier to stomach AGF within a portfolio of stocks. The two top mutual funds holding AGF shares are IA Clarington’s Canadian Small Cap fund and Fidelity Canadian Opportunity fund. According to Morningstar, IA Clarington is a “4 star” fund and Fidelity a “5 star” based on previous performance. The Seniority Spread Canadian preferred shares also provide a nice yield today and I really like Canadian preferred shares. As the other chart shows (thank you Hymas Investment Management) the after tax spread between what you can get on a perpetual preferred share in Canada versus a corporate bond is near an all time high of roughly 4% in favor of preferred shares. The problem is that there are no “good” preferred share funds in Canada. And I researched them all. For example, while Purpose Investments espouses the virtues of holding preferred share their fund has earning a negative 4.5% year to date and negative 19% over the past year. How is this possible? Because the fund mirrors the index which holds primarily interest rate reset preferred which pay less when rates fall. So I am back to Canadian dividend funds for yields.

|

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|