|

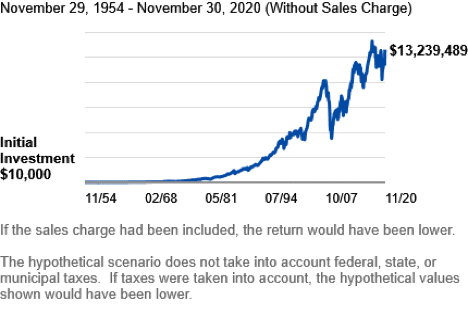

Markets Offer Value Versus Bonds Investors Enthusiasm Infectious This past 12 months has seen remarkable gains from the lows in March, 2020 as the world Governments have intervened with massive stimulus to keep interest rates low and also did their own purchasing of securities in the open market to buoy bond and stock prices. The prospect of a vaccine and the possibility of the economy returning to “normal” have led to enthusiasm that is certainly overdone in some areas of the market but in other areas deep value still exists. In my own area of small capitalized Canadian securities, I can still see a number of underpriced securities. For example, I own shares of AGF that have no debt and trade at less than 50 cents on the dollar. I also own Genesis Land Development out of Calgary that has a book value greater than $4.60, little debt and trades at $2.25 or again less than 50 cents on the dollar. Historically I have not seen values this cheep unless companies were losing money. These companies are consistently profitable but no one really cares. In contrast, I can also see companies where it becomes obvious that the main job of wall street brokers is to push prices higher and higher. For example, BRP Inc. which makes snowmobiles has risen from under $25 a year ago to trade above $110 today even though they still have a negative book value. What is even more discerning is the trading of securities that are worthless and yet trade as there is some potential value when there really is none at all. My favorite is Hertz Rent a Car that declared bankruptcy in May of 2020 and yet the shares trade up 5% today and have gained more than 100% from their lows in just March of this year. These shares are worthless. Zero. Common shareholders are absolutely guaranteed to get zero. Is this an isolated stock? Nope. Chesapeake Energy shares were up roughly 300% since the start of the year at $4.65 in January even though they declared bankruptcy last June. While they did emerge from bankruptcy in early February all existing value went to their creditors: “Each holder of an equity interest in Chesapeake, including our common and preferred stock, would have such interest canceled, released, and extinguished without any distribution.” Templeton Growth Chart Investing in equities for the long term makes sense as evidenced by Templeton Growth Fund’s “mountain chart”. Their website shows this fund as having averaged over 10% per year since its inception in 1954. This fund really made its mark in the 1973-1974 period by investing in Japanese securities and largely avoided the collapse in US equities during that time. Is China the next Japan today? Maybe. Trimark Fund Revisited Another fund with an outstanding long term track record is the Trimark Fund. It has been renamed the Invesco Global Companies Fund and was first offered in September of 1981 and has also averaged in excess of 10% per year since inception. Funds similar to this include the Edgepoint Funds whose managers came from Trimark, and CI Blackcreek funds whose manager also came from Trimark. Again, their performance numbers average roughly 10% per year over long periods of time. Managers of these funds concentrate on purchasing securities of businesses that can compound their earnings at above average levels of growth over a long period of time. Fear, Greed, and Impatience So why is it so difficult to make money investing? Fear of losing is the biggest deterrent to investing. Generally, equity prices become cheap whenever there is bad news in the economy. If prices just went down without the emotional attachment of fear most investors could likely hang on to their funds during periods of disruption. Try explaining to a client that they should hold onto their investments when New York is shutting down like last March because of the virus? Not easy. But bad news is generally temporary and stock declines also therefore temporary. Greed is also difficult to fight against. We have a no leverage policy in the firm to stop clients from investing borrowed money which they only seem to want to do once their investments have performed well and it seems safe. Also, most people have no idea of relative value as they only understand prices going up or down. I use book value as my main indicator where stocks are cheap when they can be purchased at a discount to book and expensive depending on the premium. For example, Canadian bank stocks traded at a discount to book in 1982 and have traded between book value and 2 times over the past 40 years. The exception was in 2007 when they traded at 3 times – a huge warning sign not to invest. Currently they are at roughly 1.70 times book. Impatience is also difficult to overcome as some periods of time can be very unrewarding to investors. For example, the value style has been out of favor versus growth for almost 10 years. But, the start of this year has shown a resurgence for value and growth fund returns have been muted. The Cassandra complex is named after the Goddess who was given the power to see the future but no one believed her. Investing based on insight into the future is speculation. It cannot be successfully done. |

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|