|

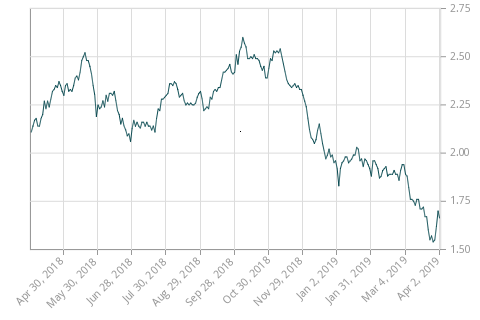

Oil Recovers With Markets - By Dan Good Yields on 10 year Government of Canada bonds rose to 2.5% in October of last year but have dropped to just over 1.6% today. This lower yield has made stocks much more attractive and gains so far in 2019 have been robust. Last fall there was a fear that the Federal Government of the U.S. would continue to increase their discount rate – the rate that is charged to the best borrowers – which would have put a damper on the economy. But the Feds had a change of heart as they saw the economy weakening and now they are seen as not likely to increase this rate further. A higher borrowing rate would make it more difficult for consumers and could actually push the economy into a recession. International Investing I am not convinced that the American market can continue to rise as U.S. optimism has led to overpricing stocks and they are not fundamentally cheap by any measure. The next years will likely see the continued rise of the European market; with interest rates at zero on German Government bonds it can’t get much worse. As well the emerging markets should continue to gain. As John Templeton would say you go to where the crowds are not if you want to purchase securities trading at a discount. In fact it is this “bad news” of low to no economic growth in Europe which is keeping investors away. As for the emerging markets, like China, optimism may soon bloom again. The Chinese market was the best performing market so far this year with gains in excess of 20%. I have a chart in my office of the Trimark Fund versus the Trimark Canadian Fund showing the growth of both funds over a 20 year period since their inception in 1982. Going “international” with the Trimark Fund would have given you an extra few percentage gains over going “Canadian” during this period. In dollar terms, a $10,000 investment in the Canadian Fund would have amounted to just over $100,000 in 20 years; the international Trimark Fund would be in excess of $200,000. This makes theoretical sense as limiting your stocks to a pool of roughly 3% of the world market with Canada is not likely to contain as much value as an international pool of Companies. But international investing does come with additional risk since your funds are invested in non-Canadian securities. But, the currency risk of investing internationally can be mitigated by focusing on “hedged” funds where the risk of our dollar going up is hedged away. Since it is still quite possible that oil can continue to rise this year and with our dollar being a petrocurrency, our dollar may rise if oil continues its ascent. Cheap oil has helped the American economy immeasurably but a rise in oil prices would likely have the opposite effect. So I am watchful of oil price shocks as we have seen in the years 1981, 1990 and more recently in 2007. Each of these spikes in oil price was followed quite quickly by a decline in the economy and a subsequent fall in equity prices. Therefore, it might be frugal to invest in that factor that is known to “cut the market off at its knees” when the markets are trading at inflated prices. That would be our natural resource stocks. The Market is Seasonal The short term returns of equities have followed a fairly predictable pattern over the years. I have been a witness to this seasonal effect over the 35+ years of my career as I have seen this pattern play itself out. Basically, most of the gains in the equity market occur during the first 5 months of the year. This isn’t to say the market drop after the end of May but figures suggest the gains after May amount on average to only a few percentages. What this means is that you may want to look at investing as a “risk on” and “risk off” trade. If you focus on making money the first few months you can focus on being more conservative during the latter months. While I do not think it is wise to “trade” the market based on its seasonal nature you should be aware of its occurrence and can plan a strategy to take advantage of opportunities. The Passing of John Bogle Recently John Bogle who was the founder of Vanguard funds passed away. He is basically known in the investment industry as leading the “charge” on the benefits of low cost index funds. He has published a number of books on investing as well. It is difficult to argue against the benefits of low cost index investing over the past 10 years as this period has seen the markets spike upwards from their lows of the 2009 crisis. But I also remember looking at a mutual fund listing of all available funds in Canada prior to 1985 where the 10 year numbers showed 4 active funds standing out from the crowd. The average fund had gained nothing over this period but the Cundill Value fund, Templeton Growth fund, AGF Special and Industrial Growth all averaged in excess of 10 % per year during this period. So while you can purchase a low cost index Vanguard Fund from me the popularity of index investing is not a good sign. To be successful you have to be contrarian. Government of Canada 10 Year Bond Yields Focusing on Yields They say when you are on a boat it is calming to focus on the shore where it is stable rather than looking at the boat against the water which bobs relentlessly. So while the press and many in the investment industry like to focus on the ups and downs of the market, I like to focus on yield – what securities are paying. The above chart shows long term Government of Canada bonds yield under 2%. According to FRED (The Federal Reserve Bank of St. Louis) the yield on B rated corporate bonds is 4.7%. With the price/earnings ratio on equities of roughly 18 you are getting roughly 5.5% on equities. So I still like equities but corporate bonds are more stable. Government bonds do not yield enough for me.

|

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|