|

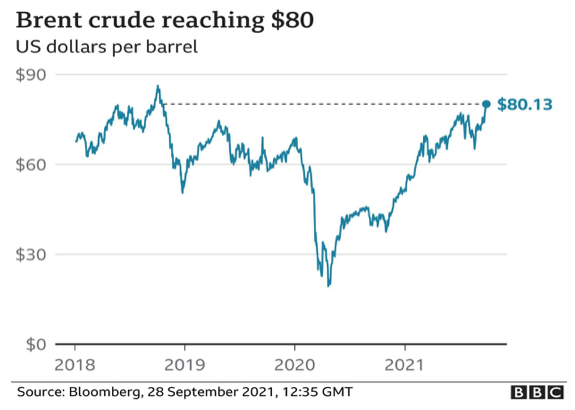

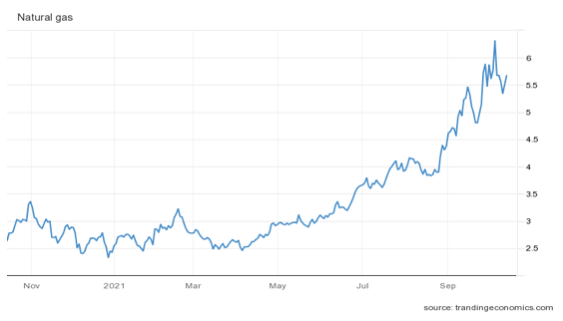

It's All About Oil and Gas Oil and natural gas prices have continued to rise with the prices of both commodities more than doubling this year. While this is good news for shareholders of existing resource stocks, a few companies like Husky Energy threw in the towel in January and were bought out by Cenovus. My auditor recently asked me to look at Cenovus as her broker mentioned it was a “good value”. When I get tips like this I usually run in the opposite direction. I am a below book value investor and tend to focus on buying shares when they are priced as a distressed security not during times of exuberance. A few oil and gas producers like Suncor and Imperial Oil are held by Dan Dupont’s Fidelity Canadian Large Cap Fund along with a smattering of bank stocks as Dupont is betting on a continued recovery in Canada’s economy. Edgepoint was also a big fan of Canadian oil stocks as was Mackenzie’s Global Resource Fund which has risen close to 40% to date. While there are times to own oil and gas producers, these businesses are capital intensive with often low or nonexistent returns to shareholders. Better to be holding companies than can grow their earnings over a long period of time so I would look at exiting some of these resource funds by early next year. Buy When it Snows, Sell When it Goes

While market timing is generally a futile exercise, most of the market’s gains historically occur in the fall and into the first part of the new year. I’m not worried about any correction as dividend yields far exceed what investors can achieve by holding their money in bank deposits. While interest rates have continued to rise from the lows of 2020, rates are still well below dividend yields of 4 to 5%. As for timing, I remember selling Algoma Central which does shipping on the Great Lakes at roughly $11 in the fall many years ago with the prospects of buying it back at a lower price after they show their losses when the Lakes are frozen. The price never did get below this $11 mark so I missed out on some future gains. Currently it trades at the equivalent price of $174. I would wager more money is lost trying to time the markets than holding through any major market drops. A cool value story was Dorel that manufactures bicycles and traded under 10 cents on the dollar at $1.35 in March of 2020. It was $23 today. Who needs to gamble on cryptocurrency to make money? Leave a Reply. |

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|