|

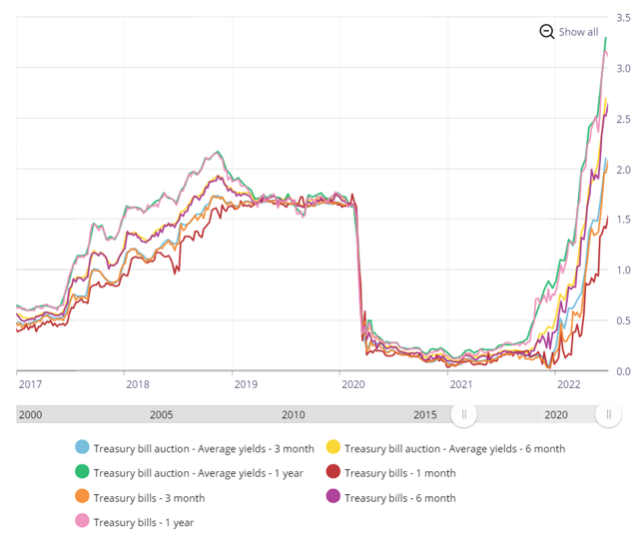

It is All About Oil When oil prices go up, Governments tend to worry about inflationary pressures and generally raise short term interest rates to quell prices from “getting out of control”. This has been particularly painful for investors in not only stocks but bonds as well. The problem is that Governments try to inflict just the right amount of pain but not so much as to kill the patient (the economy) with a recession. The Goldilocks’ conundrum. I recently met with the manager of Mackenzie’s Global Resource fund and he reiterated that he does not feel oil prices are set to rise from today’s level and actually holds 10% of his fund in cash which is the maximum amount of cash this fund can hold. I would recommend taking profits from any Resource funds. Fund Focus One of the top performing funds so far this year (other than resource funds) has been the Fidelity Large Cap Canadian fund run by Dan Dupont which has returned some 5.8% so far this year. Fidelity’s China Fund was also positive at 4.3%. These are terrific results relative to the TSX which has lost some 11% in the past 6 months, the NASDAQ which has lost some 28% and the S%P 500 which is down 20%. At the other end of the spectrum (skipping crypto funds) is the Dynamic Power Global Growth fund run by Noah Blackstein which has lost some 40% so far this year. I only mention this fund because it is a great long-term performer, averaging some 11% per year over the past 10 years. According to Morningstar over the past ten years it has been in the top 5 percentile of all funds in 4 of those years and bottom 98% of all funds in 3 of those years. This fund is a pure momentum fund but not for the faint of heart. For bond funds the pain has also been monumental as evidenced by the iShares Core Long Term Bond index ETF which has dropped 21% year to date. Treasury Bill Yields The Good News

With the yield curve flat (the 10-year Government of Canada bond rate is about the same as the treasury bill rate) interest rates have actually started to head down. Oil is also down some 10% just today. Our dollar has also dropped some 1.5% as well which makes international investing more profitable. I am expecting the Government to take their foot off the interest rate pedal and let short term rates return to where they should be, well below long term rates. This will be beneficial to the equity and bond markets. Leave a Reply. |

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|