|

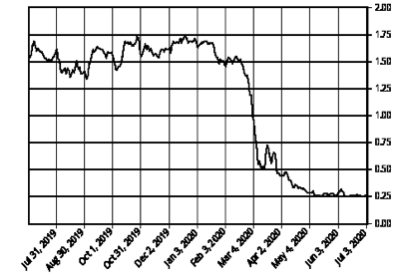

Markets Rally on Government Stimulus Even Leaky Boats Float The last 3 months has been one of the largest market rallies in history as Government intervention has stabilized employment losses and the functioning of the capital markets. This has created unbridled optimism against a backdrop of ever increasing COVID cases in the United States and world wide. As I write this, the China economy is leading world economic growth as evidenced by the fact their stock market rose over 5% just yesterday and markets in the U.S. and Europe are also advancing. I had read earlier about one of the top analysts with Credit Suisse remarking that we may actually experience an increasingly strong market rally in equities which could easily lead to over exuberance and ever loftier equity markets. Considering he is consistently one of the top 10 analysts in the world and not just a Facebook poster, I have one foot in his camp. His reasoning is rather simple: world Governments are in the housing market buying mortgages to support the banks, the corporate bond market including “junk” bonds to support business borrowing, and Government bonds to keep interest rates low for consumers. With yields on 5year Government Bonds dropping below .40% and yields on equities in excess of 5% equity and corporate bond markets have only one direction to go. Up But the Markets are Expensive Yes, the stock markets are near historical high levels with the NASDAQ actually setting records nearly every day. But the relative value they offer is still compelling. I remember meeting with my mother-in-law a number of years ago after she first moved to Vancouver and she was considering buying a home. I suggested that real estate in Vancouver was rather expensive which it was relative to Edmonton and relative to its past history of prices. What I failed to take into account was the ever-increasing demand fuelled by immigration into Canada, primarily from Hong Kong at the time as Hong Kong was just coming out from under Chinese rule after 156 years as a crown colony of Great Britain. Adding to this was a “local” demand from an aging population of retirees like her escaping the colder climate of Edmonton and you got ever increasing real estate prices. Markets will continue to rise with world Governments “willing to do anything” to support the economy and the capital markets, plus a flood of GIC refugees not satisfied with the rates they will be getting on their bank and term deposits. This demand overshadows the real economy that has been devastated with something like 8 million Canadians on some type of social assistance today. My fear is that a rise in interest rates caused by excessive borrowing could put a damper on the party. Momentum is Building Nostalgia has become a greater part of our lives as people yearn to return to the freedoms they once had. Being stuck at home, my evenings are spent filled with Sienfield reruns and replays of Oilers games from the glory years of the1980s. One of the sports clips I saw recently was a replay of some game in which Joe Montana led his team from something like a 35 point deficit to eventually win the game. As Joe and Peyton Manning remarked in their interview, momentum is an incredibly powerful force. The stock markets are going through a similar experience with the NASDAQ having been down some 35% and then gaining it all back and then some. Is this momentum petering out? Not that I see. Investing is not for the Timid Investors are being well paid for taking risk today. The difficulty with most investors though is that they generally fail to have a strategy or plan. Some will bail when prices drop which is the absolute worst thing you can do. You also have to ask yourself if the pandemic is temporary and if it is then stock prices were bound to recover. As for the do it yourself investor you should have some ability to read financial statements otherwise you will be fleeced. Individual securities are being traded that have little to no value. A recent example is with Hertz Rent a Car that declared bankruptcy. The shares will be worth zero. Nothing. Yet they trade at close to $2 today. The creditors even went so far as wanting to do a share offering to the public to bring more sucker money in to pay off the creditors. But other companies like BRP which make snowmobiles and all terrain vehicles also defy gravity. Their shares have tripled from March lows and yet their shareholder equity has dropped from -$3 per share to -$9 in 6 months. Bond Yields Collapse to .25%

As the above chart shows, 1-3 year Government Canada Bonds have all but collapsed. Oil and gas drilling has all but disappeared in Alberta, commercial real estate is as depressed as ever. Just walk through downtown Edmonton or Calgary. Retail is disappearing in favor of online purchases. Edmonton is going to be in rough shape for years to come. Alberta recently had their debt rating lowed. As did Canada. So where is the good news? If you are a deep discount value guy, asset-based developers like Melcor in Edmonton and Genesis in Calgary can be purchased at roughly 20 cents on the dollar today. I literally bought Genesis shares many years ago at 50 cents when they were worth $1.00. In 2007 the shares rose to over $5. A “ten” bagger. Now they trade at $1.25 and are worth $4.60. We will see what happens. The vultures are circling. Stay safe. Let’s get through this pandemic in one piece! Leave a Reply. |

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|