|

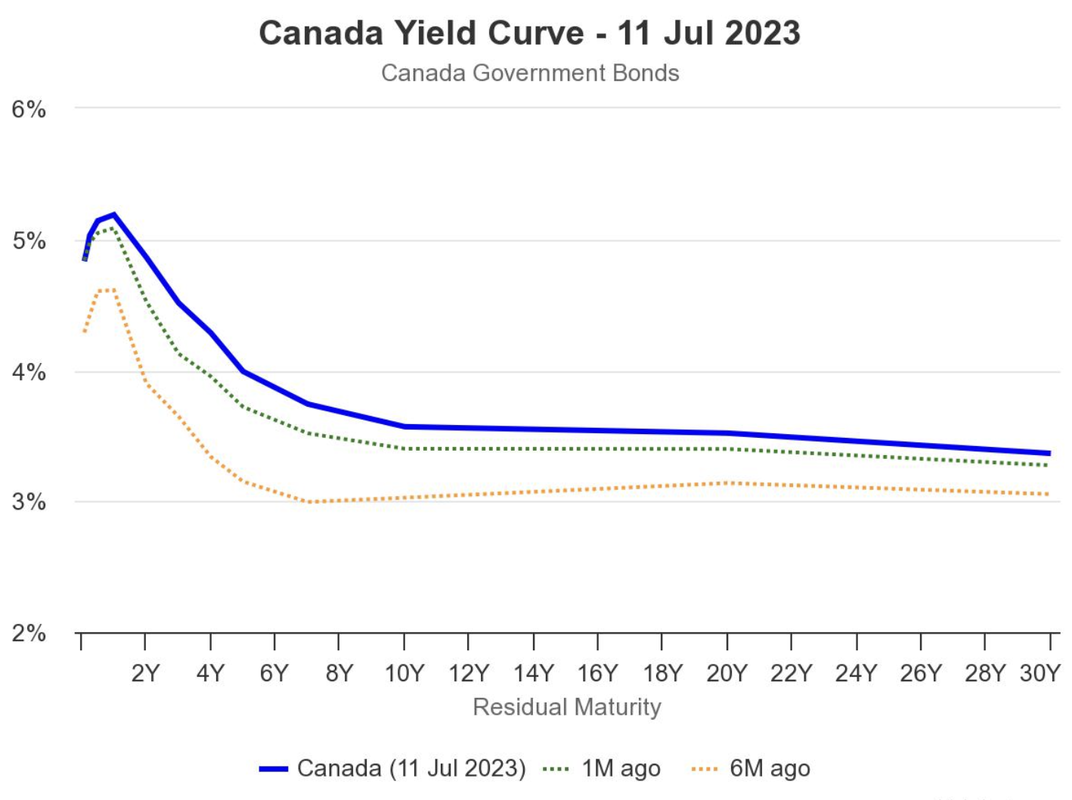

The current Bond Yield chart shows Canada one-year bonds paying 5.18%- and 30-year bonds yielding 3.36%. Contrast this with China where one-year bonds yield 1.8%- and 30-year bonds yield 3.02%. Suffice to say the Government of Canada is trying to put the brakes on a supposedly overheated economy and China is trying to revive growth. Some Value Examples? Last newsletter I gave a few value examples, namely AGF, Canadian Western Bank and Laurentian Bank. The reason I bring this up again is that Laurentian Bank just announced today that it is putting itself up for sale. The shares increased by 30% on the news and even at $45 per share are still well below their book value of $62. Mackenzie Financial is the only mutual fund in Canada that has a significant position in Laurentian. There are still some incredible value examples in Canada which lead me to believe the fear of inflation is overdone. A recession though, is a possibility with interest rates so high. Royal Bank of Canada, TD Canada Trust, Bank of Montreal, Canadian Imperial Bank of Commerce, National Bank of Canada and Bank of Nova Scotia announced that they are increasing their prime rate by 25 basis points to 7.2 per cent from 6.95 per cent, effective on July 13. Anyone taking out a mortgage today or having a floating rate on existing debt is going to have trouble just carrying this debt. Asset Allocation

Asset Allocation in the investment industry is mostly nonsense. Whether you should have 60% of your portfolio in stocks and 40% in bonds or vice versa based on your age and temperament makes no logical sense. You should buy and hold securities, whether they are stocks or bonds, when they represent good value, otherwise you should be invested in cash. Bonds currently represent good value. If inflation is going to be targeted by the Government at 2% and you can get 5% today on a 1-year bond, you are getting good value. Bonds are rarely the best investment though as stocks tend to yield similar amounts and their dividends grow over time. For example, shares of Royal bank yield over 4% currently and they are likely to increase their dividends over time as they have in the future. So, I would go with a good stock portfolio every time. The “problem” is one of volatility. When stocks go down it will look like you are losing money. For example, I have shares of Algoma Central which yield roughly 10% with dividends and special dividends over the years. The shares have dropped 7.5% so far this year. As an investor, I am happy these shares have dropped as it provides me the opportunity to buy more shares at a lower price. Investing is a long-term game so I will sit on my shares, buy more, and have the faith the shares will rise in the future. Leave a Reply. |

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|