|

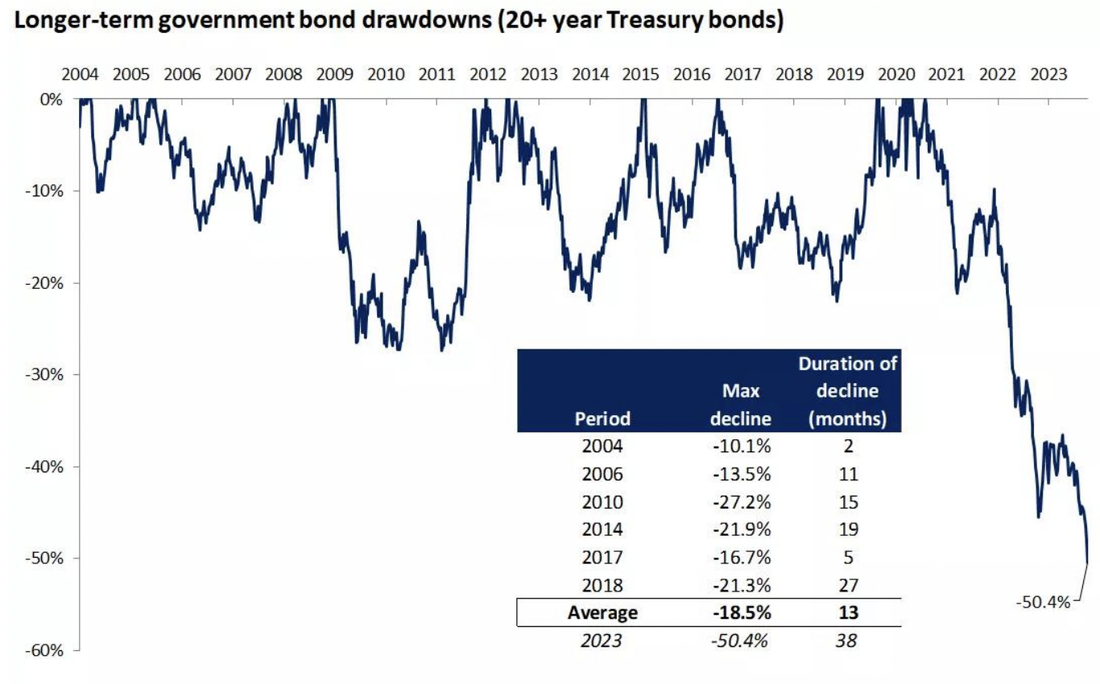

Bear Market in Bonds Continues As you can see, the carnage in the bond market has continued with interest rates still climbing. What this means for holders of bonds has not been pleasant as longer-term bonds have lost roughly 1⁄2 their value over the past 38 months. The other way to look at it is bonds are 1⁄2 price compared to their lows some 3+ years ago and now pay their highest yields in 20 + years. Source: FactSet, Edward Jones. iShares 20+ Year Treasury Bond ETF. Past performance does not guarantee future results. Being an Investor Not a Trader The month of September was not kind to stockholders as expectations of a pause and then drop in interest rates changed to a higher for longer mentality. Higher rates are generally not good for stocks as borrowing costs rise and the likelihood of default on loans rises. For example, Morguard that owns and runs the Bonnie Doon mall where my office is located, is a screamingly cheap stock today, trading at roughly 28 cents on the dollar according to Yahoo Finance. Buy it carries over $6 billion in debt which is roughly 1.5 times its equity and it is obviously having difficulty making its interest payments much less paying down its debt. Canadian banks are not immune either as they carry a lot of bonds on their balance sheet (this has not been a good asset to hold over the last 38 months as the above chart points out) as well as holdings in commercial real estate or loans to commercial real estate firms which may default. My bet is still on Canadian bonds as rates are high and if they go up any more then you will likely have a recession in Canada and more damage to the economy. In 1981 we had a similar situation where rates kept going up so people avoided bonds since their prices kept going down. So stocks were the only game in town. This ended up being a losing bet with the recession of 1982. As has happened in the past, it is easier to do what your neighbour is doing rather than being a contrarian. I would rather be a contrarian and be wrong for awhile. Patience will be rewarded. Emerging Markets Make Sense Today

According to Mackenzie Financial Emerging market stocks have fallen to their lowest valuation relative to the S&P 500 in at least 36 years. One of the difficulties with emerging markets is that much of their debt is denominated in US dollars where high US interest rates have supported the currency to the detriment of local currencies. Hopefully this will change if/when the U.S. can ease off on keeping rates so high. As I have stated previously, something has to happen to correct the inverted yield curve (where short term rates are higher than long). This usually means a recession or at least a slowing of the economy. So for me China is a place I would park some of my money as their economy has already slowed. Maybe oil prices will also stay higher for longer so resource funds may continue to perform well given inflation expectations and the lack of investment in this area due to Government constraints and bank policies. We will see. |

Archives

April 2024

Sign up for our Newsletter here.

|

|

Contact

Suite 256, Bonnie Doon Shopping Centre 82 Avenue & 83rd Street Edmonton, Alberta T6C 4E3 Phone | (780) 433-5449 |

Copyright © DW Good Investments Co. Ltd. 2015

|

Website design by Robin Design 2015

|